- শিক্ষা

- ট্রেডিং স্ট্রেটেজি

- এনগালফিং ক্যান্ডেলস্টিক স্ট্রেটিজি

Engulfing Candlestick Strategy

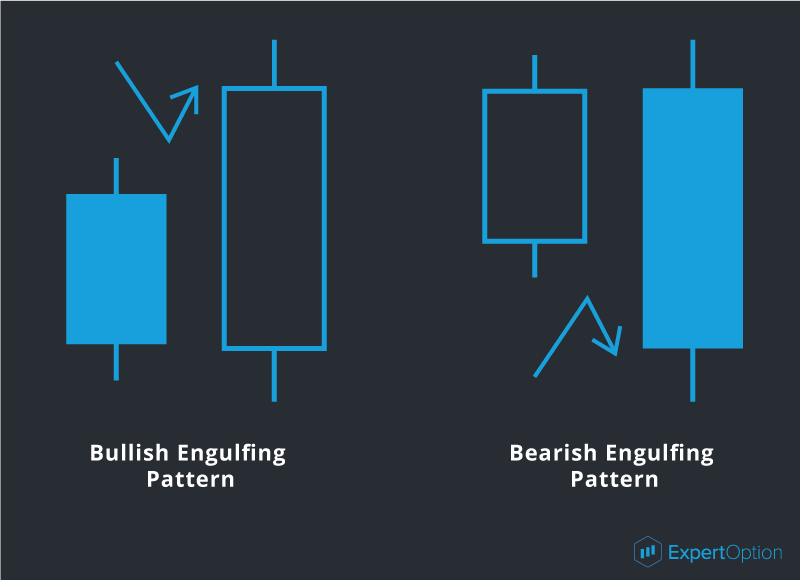

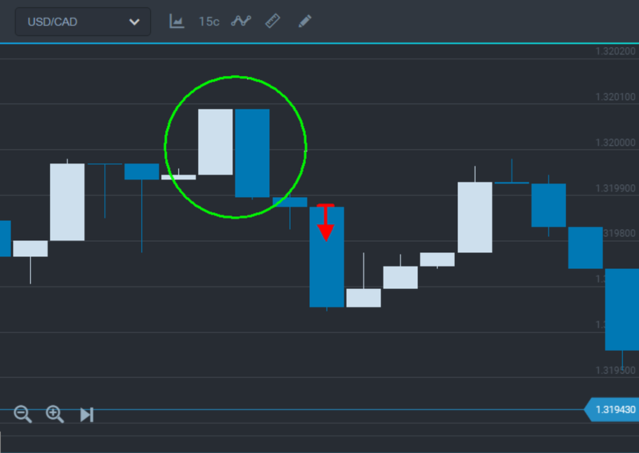

This pattern indicates a reversal in price movement. We see this signal after a candlestick has appeared and its body is bigger than the previous reversal candlestick, known as an engulfing candlestick. Once this signal appears, it's important to be alert and observe the direction of the subsequent candlestick. If the following candlestick moves in the same direction as the engulfing pattern, consider opening a deal after its closure.

What to do when this signal appears:

1) See a bigger candlestick in the opposite direction to a previous candlestick.

2) Wait for a new candlestick confirming a direction.

3) Open a deal in the engulfing direction after closing a new candlestick.

Buying a put after a bearish engulfing pattern

The strength of the price movement after a reversal is directly proportional to the size of the engulfing candlestick. When dealing with a substantial engulfing candlestick, especially if you've gained some profit, there's potential for online trading after its closure. However, it's crucial to be patient and wait for confirmation of candlestick signals before making any moves.